President Trump indicates beef price on his radar

On October 16, 2025, President Donald Trump said the price of beef is “higher than we want it, and that’s going to be coming down pretty soon.”

In his speech, President Donald Trump discussed plans to help lower the cost of IVF treatments. Following questions from the press on this topic as well as global concerns and other issues, the president commented on the state of the U.S. economy, how his policies have lowered the price of consumable goods, and then mentioned the price of beef.

“We are working on beef, and I think we have a deal on beef that’s going to bring the price of beef, that would be the one product that we would say is a little bit higher than we want it, maybe higher than we want it, and that’s going to be coming down pretty soon too, we did something, we worked our magic,” said President Trump.

Feeder cattle and live cattle futures both dropped on Friday, Oct. 17. Live cattle futures closed $6-$7 lower for the day, and feeder cattle futures closed limit lower at $9.25.

Rich Blair, a market participant and futures broker from Sturgis, South Dakota, said that the market did likely react to President Trump’s statement.

“I think pretty definitely the downturn in the futures market today was a reaction to Trump’s statement,” Blair said. “If you want to be technical about it, he did what he said he would do, he’s already brought down the price of beef on the future’s market.”

It is too early to determine how retail beef prices will react, and how the cattle market will be impacted over the long term.

“We traded fed cattle in the country $5 higher than last week so far, and although it’s too early to say as far as calf prices, it doesn’t look like they have changed much at this point,” Blair said.

Speculation on social media about what the president’s comment means is rampant.

“We have no details about how he plans to bring down prices, and the conclusions people jump to are the bad thing about it,” Blair said. “You could say President Trump is at fault for the reaction in the market, but it is also due to people coming up with ideas that spread like wildfire on social media. It’s just the times we’re living in. News travels so fast and there is so much speculation on what this means or what that means.”

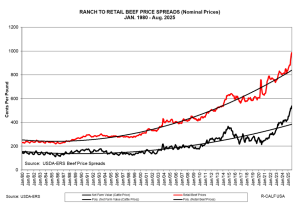

High prices create extreme volatility in the cattle markets, Blair said.

“We have never been close to these prices before, and people buying at these prices are pretty nervous. If something changes they get really nervous. I don’t expect the volatility to decline any time soon. I would assume it’s increasing and will continue to increase as prices adjust both ways.”

Speculations about how the president intends to lower beef prices have ranged from lowering tariffs on Brazil or Argentina to the possibility of opening the U.S./Mexico border, but these ideas are only speculations, Blair said.

“That is not what President Trump has said he’s about: he is about making the U.S. first, and helping U.S. farmers and ranchers. People are too quick to jump to conclusions, just as they did when Secretary Rollins announced a plan to help rebuild the U.S. cattle herd and people immediately assumed that meant giving out checks.

“There are very few things in my mind that Trump can do to change the cattle market that much,” he said.

Livestock Risk Protection (LRP) or futures contracts will give producers a degree of insurance against price breaks, Blair said.

“They allow you to set a floor without locking in a ceiling, just like buying fire insurance on your house.”

As far as the long term market outlook, Blair said, “Sell your calves, enjoy the price level and raise more next year. That’s what people need to do.”

Elliot Dennis, University of Nebraska-Lincoln Associate Professor of Livestock Marketing, Risk Management and Agricultural Economics said the market “downfall was due in large part to algorithm trading from the Trump headline on doing something big for the beef industry. This came on the back of record contract highs which some were speculating [on Thursday, Oct. 16] that the contracts were overbought.”

Dennis believes the Trump announcement is probably related to Secretary Rollins’ recent mention of a plan to help rebuild the U.S. beef cattle inventory, but “a lot of the trade was about [the possibility of] tariffs and opening up the U.S. to Brazilian or Argentine beef.”

“This is one of those sit tight moments,” Dennis said. “The fundamentals are still there from consumers and feeder cattle supply.”

LRP is useful as a preventative tool, but when markets correct LRP premiums are very high. “These need to be bought prior to market movements,” Dennis said.